Why a Vacation Home Is the Ultimate Summer Upgrade

Summer is officially here and that means it’s the perfect time to start planning where you want to vacation and unwind this season. If you’re excited about getting away and having some fun in the sun, it might make sense to consider if owning your own vacation home is right for you.An Ameriprise Fin

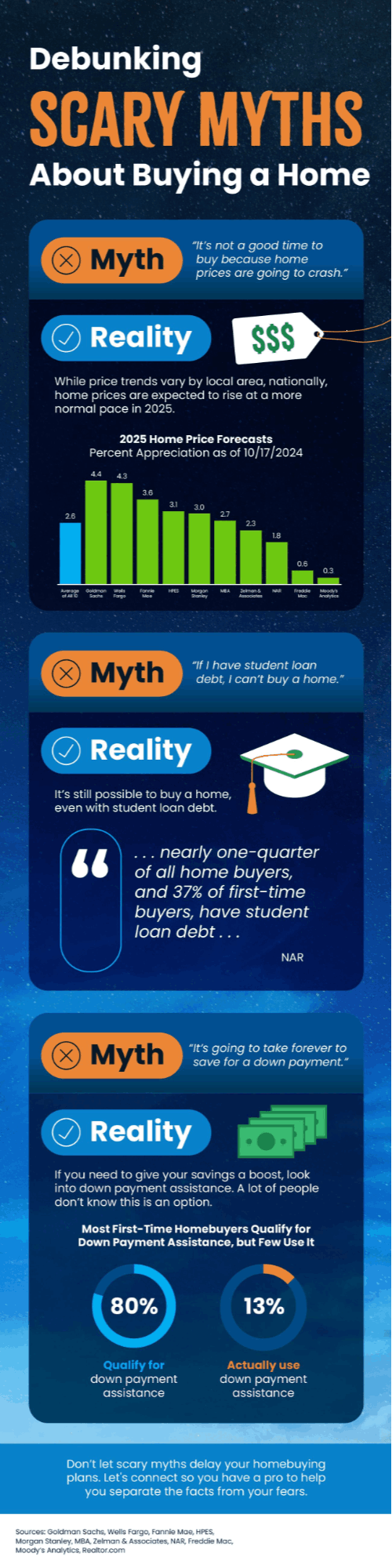

What You Need To Know About Today’s Down Payment Programs

There's no denying it's gotten more challenging to buy a home, especially with today's mortgage rates and home price appreciation. And that may be one of the big reasons you’re eager to look into grants and assistance programs to see if there’s anything you qualify for that can help. But unfortunate

Worried About Mortgage Rates? Control the Controllables

Chances are you’re hearing a lot about mortgage rates right now. You may even see some headlines talking about last week’s Federal Reserve (the Fed) meeting and what it means for rates. But the Fed doesn’t determine mortgage rates, even if the headlines make it sound like they do. The truth is, mor

Categories

Recent Posts