What To Know About Closing Costs

Now that you’ve decided to buy a home and are ready to make it happen, it’s a good idea to plan for the costs that are a typical part of the home-buying process. And while your down payment is probably the number one expense on your mind, don't forget about closing costs. Here’s what you need to know.What Are Closing Costs?Simply put, your closing costs are the additional fees and payments you have to make at closing. And while they’ll vary based on the price of the home and how it’s being financed, every buyer has these, so they shouldn’t be a surprise. It’s just that some people forget to budget for them. According to Freddie Mac, this part of the home-buying process typically includes: • Application fees• Credit report fees• Loan origination fees• Appraisal fees• Home inspection fees• Title insurance• Homeowners Insurance• Survey fees• Attorney fees Some of these are one-time expenses that are baked into your closing costs. Others, like homeowners’ insurance, are initial installment payments for ongoing responsibilities you’ll have once you take possession of the home.How Much Are Closing Costs? The same Freddie Mac article goes on to say: “Closing costs vary greatly depending on your location and the price of your home. Typically, you should be prepared to pay between 2% and 5% of the home purchase price in closing fees.” With that in mind, here’s how you can get an idea of what you’ll need to budget. Let’s say you find a home you want to purchase at today’s median price of $422,600. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $8,452 and $21,130.But keep in mind, if you’re in the market for a home above or below this price range, your numbers will be higher or lower.Tips To Reduce Your Closing CostsIf you’re wondering if there’s any way to inch that down a little bit, NerdWallet lists a few things that could help: Negotiate with the Seller: Some sellers are willing to cover part or all of these expenses — especially since homes are staying on the market a bit longer now. Sellers may be more motivated to compromise, and you’ll find you have a bit more negotiation power. So don’t hesitate to ask them for concessions like paying for the home inspection or giving you credit toward closing costs. Shop Around for Home Insurance: Since rising home insurance is a challenge in many areas of the country right now, take the time to get a clear picture of all your options. Each insurance company offers its policies and coverage, so get multiple quotes and see how they compare. Choosing a policy that provides reliable coverage at a competitive rate can make a difference. Look into Closing Cost Assistance: Just like there are programs out there to help with your down payment, options exist to get support with closing costs too. While they’ll vary by area, there are programs for various income levels, certain professions, and specific towns or neighborhoods. If you want to learn more, Experian says: “Your real estate professional should be able to steer you toward applicable programs, and the U.S. Department of Housing and Urban Development (HUD) maintains a helpful resource for finding homebuying assistance programs in every state.” Bottom LinePlanning for the fees and payments you'll need to cover when closing on your home is important – and it doesn’t have to be a big surprise. With the right experts on your side, you can make sure you’re prepared. Let’s connect so you have someone you can go to for more tips and advice.

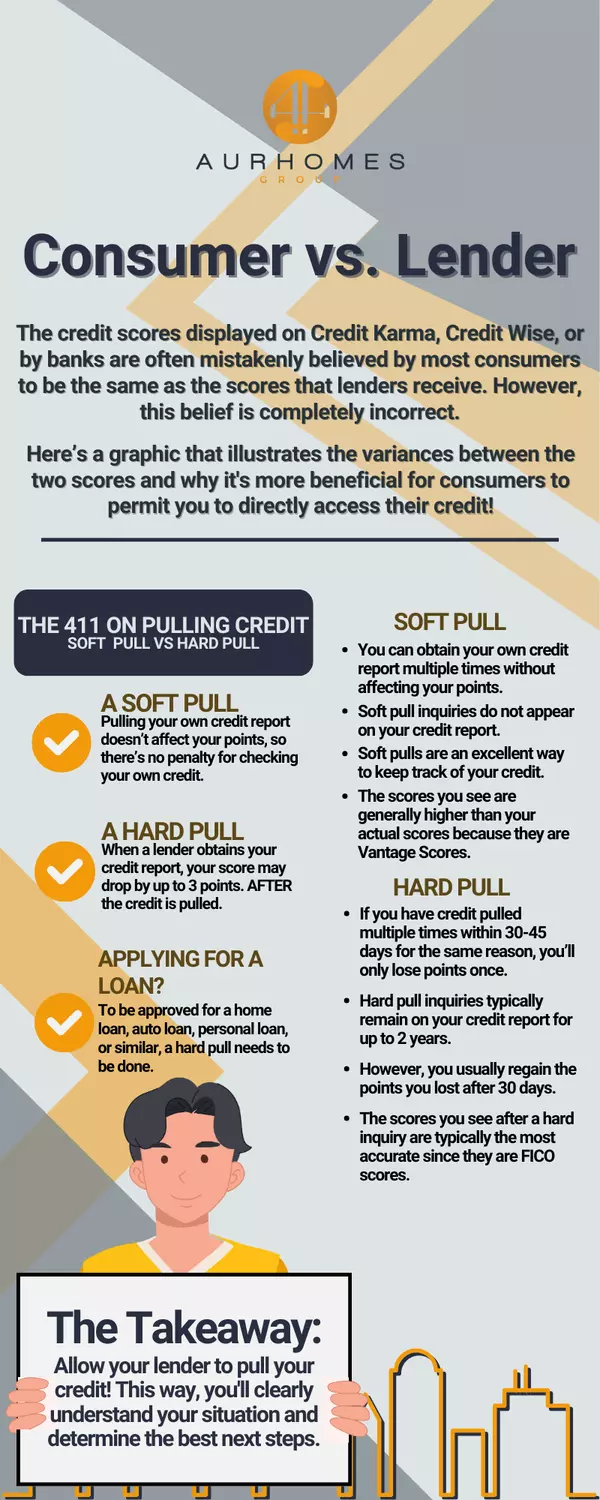

Consumer vs. Lender: Why Your Credit Score from Apps Like Credit Karma Isn't What Lenders See

Many consumers are unaware that the credit scores they see on platforms like Credit Karma or Credit Wise are different from those used by lenders. This common misconception can lead to confusion and missed opportunities. In this blog post, we’ll clarify these differences and show why allowing direct access to your credit report is often the best approach. Check out the graphic below to understand how these scores vary and how it can benefit you. For personalized assistance and to ensure you're getting the most accurate credit information, contact Aurhomes Group today!

Are We Heading into a Balanced Market?

If you’ve been keeping an eye on the housing market over the past couple of years, you know sellers have had the upper hand. But is that going to shift now that inventory is growing? Here’s a breakdown of what you need to know.What Is a Balanced Market?A balanced market is generally defined as a market with about a five-to-seven-month supply of homes available for sale. In this type of market, neither buyers nor sellers have a clear advantage. Prices tend to stabilize, and there’s a healthier number of homes to choose from. And after many years when sellers had all the leverage, a more balanced market would be a welcome sight for people looking to move. The question is – is that really where the market is headed?After starting the year with a three-month supply of homes nationally, inventory has increased to four months. That may not sound like a lot, but it means the market is getting closer to balanced – even though it’s not quite there yet. It’s important to note this increase in inventory is not leading to an oversupply that would cause a crash. Even with the growth lately, there’s still nowhere near enough supply for that to happen.The graph below uses data from the National Association of Realtors (NAR) to give you an idea of where inventory has been in the past, and where it’s at today: For now, this is still seller’s market territory – it’s just not as frenzied of a seller’s market as it’s been over the past few years. As Mark Fleming, Chief Economist at First American, says:“The faster housing supply increases, the more affordability improves and the strength of a seller’s market wanes.” What This Means for You and Your MoveHere's how this shift impacts you and the market conditions you'll face when you move. Lawrence Yun, Chief Economist at NAR, explains:“Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis.” The graphs below use the latest data from NAR and Realtor.com to help show examples of these changes: Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to price your house right if you want it to sell. If you don’t, buyers might choose better-priced options.Sellers Are Receiving Fewer Offers: As a seller, you might need to be more flexible and willing to compromise on price or terms to close the deal. For buyers, you could start to face less intense competition since you have more options to choose from.Fewer Buyers Are Waiving Inspections: As a buyer, you have more negotiation power now. And that’s why fewer buyers are waiving inspections. For sellers, this means you need to be ready to negotiate and address repair requests to keep the sale moving forward.How a Real Estate Agent Can HelpBut this is just the national picture. The type of market you’re in is going to vary a lot based on how much inventory is available. So, lean on a local real estate agent for insight into how your area stacks up.Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights, so you know exactly what’s happening and how to navigate it. Bottom LineThe real estate market is always changing, and it’s important to stay informed. Whether you’re buying or selling, understanding this shift toward a balanced market can help. If you have any questions or need expert advice, don’t hesitate to reach out at Aurhomes Group.

Categories

Recent Posts